Lease Semi Trucks For Sale: Your Pathway to Ownership on the Open Road sale.truckstrend.com

The dream of owning a semi-truck, whether for an aspiring owner-operator or an expanding fleet manager, often collides with the formidable upfront costs. A brand-new rig can easily run into six figures, while even a reliable used truck demands a substantial capital outlay. This financial hurdle can seem insurmountable, but there’s a strategic pathway that bridges the gap between aspiration and reality: Lease Semi Trucks For Sale.

This phrase, at first glance, might seem contradictory. How can something be "for lease" and "for sale" simultaneously? It refers to specific types of leasing agreements, primarily lease-to-own (LTO) or finance leases, where the intention from the outset is for the lessee (the person or company leasing the truck) to eventually become the owner. Unlike a traditional operating lease, which is essentially a long-term rental, these programs are structured as a progressive path to outright ownership, making them a compelling alternative to conventional purchasing or financing. For many, it represents the most practical and financially prudent method to acquire a vital asset, allowing them to hit the road and generate revenue without crippling initial investments.

Lease Semi Trucks For Sale: Your Pathway to Ownership on the Open Road

In this comprehensive guide, we will delve into the intricacies of leasing a semi-truck with the eventual goal of ownership. We’ll explore its numerous benefits, crucial considerations, the step-by-step process, and common challenges, equipping you with the knowledge to make an informed decision for your trucking venture.

Understanding "Lease Semi Trucks For Sale": Bridging Lease and Ownership

The core concept behind "Lease Semi Trucks For Sale" lies in a specific financial instrument that blends the flexibility of leasing with the ultimate goal of ownership. It’s not about finding a truck currently under an operating lease that someone is trying to sell mid-term (though that can happen in the secondary market). Instead, it’s about entering into an agreement where a semi-truck is leased with a predefined path to transferring its title to you at the end of the lease term.

The two primary types of leases that fall under this umbrella are:

- Lease-to-Own (LTO) Agreements: These are perhaps the most direct interpretation of "Lease Semi Trucks For Sale." Under an LTO, a portion of each lease payment is often credited towards the eventual purchase price. At the end of the lease term, there’s typically a pre-determined buyout price (often a small balloon payment or a nominal fee) that, once paid, transfers ownership to the lessee. This structure is designed explicitly for the lessee to acquire the asset.

- Finance Leases (or Capital Leases): From an accounting and tax perspective, a finance lease is treated much like an outright purchase. The lessee records the asset on their balance sheet and depreciates it, and the lease payments are considered debt service. While the lessor retains legal title during the lease term, the lessee assumes most of the risks and rewards of ownership. At the end of the term, there’s typically a bargain purchase option or a fixed buyout price, making ownership the expected outcome.

These options stand in stark contrast to Operating Leases, which are pure rentals. With an operating lease, the goal is simply to use the truck for a period, after which it’s returned to the lessor. There’s usually no intention or easy path to ownership, and the focus is on lower monthly payments and off-balance sheet financing.

For individuals or businesses seeking to build equity and eventually own their fleet, focusing on LTO and finance lease options is paramount. They offer a structured, manageable path to acquiring high-value assets without the immediate capital strain of a direct purchase.

Benefits of Leasing a Semi Truck with an Option to Buy

Opting for a lease-to-own model offers several compelling advantages, especially for owner-operators and small to medium-sized trucking companies:

- Lower Upfront Costs: This is arguably the biggest draw. Instead of a hefty down payment required for traditional financing (often 10-20% of the truck’s value), lease-to-own programs typically demand lower initial payments, sometimes as little as the first and last month’s lease payment, or a small security deposit. This preserves working capital for other operational needs like fuel, insurance, and maintenance.

- Predictable Monthly Payments: Lease agreements come with fixed monthly payments for the duration of the term, allowing for more accurate budgeting and cash flow management. This predictability is crucial in an industry with fluctuating fuel prices and freight rates.

- Access to Newer Equipment: Leasing often makes it easier to acquire newer, more reliable, and fuel-efficient trucks that might be out of reach with a direct purchase. Newer models often come with better technology, improved safety features, and extended manufacturer warranties, reducing downtime and operational costs.

- Potential Tax Advantages: Depending on your specific business structure and tax regulations (consult a tax professional!), lease payments may be deductible business expenses, potentially lowering your taxable income. For finance leases, you might also be able to claim depreciation.

- Flexibility at Lease End: While the primary goal is ownership, LTO agreements can offer some flexibility. At the end of the term, you typically have the option to exercise the buyout, but sometimes also to renew the lease or, in some cases, return the truck (though this is less common for true LTOs).

- Preservation of Credit Lines: By choosing a lease, you might preserve your existing credit lines with banks for other critical business needs, such as expanding operations, covering payroll, or investing in other equipment.

- Opportunity to Build Business Credit: Consistently making timely lease payments can significantly improve your business credit score, making it easier to secure future financing or expand your fleet.

Key Considerations Before Committing to a Lease-to-Own Agreement

While attractive, a lease-to-own agreement is a significant financial commitment. Thorough due diligence is essential:

- Total Cost of Ownership (TCO): Always calculate the TCO over the entire lease term, including all payments, the buyout price, any fees, and estimated maintenance. Compare this with the TCO of an outright purchase (including depreciation, interest, etc.) to ensure it’s the most cost-effective solution for your long-term goals. Sometimes, a lease-to-own can result in a higher overall cost than traditional financing due to factors like higher implicit interest rates or structuring fees.

- Lease Terms & Conditions: Scrutinize every detail of the contract:

- Down Payment: How much is required upfront?

- Monthly Payments: Are they fixed? What’s the effective interest rate?

- Lease Term: Typically 3-7 years for semi-trucks.

- Buyout Price/Formula: Is it a fixed price, fair market value, or a balloon payment? Understand exactly how ownership is transferred.

- Maintenance Responsibilities: In most LTOs, the lessee is responsible for all maintenance and repairs, just like an owner. Understand what, if anything, the lessor covers.

- Mileage Limits: While less common for LTOs (as you’re heading towards ownership), some might have clauses.

- Early Termination Penalties: What happens if you need to exit the agreement prematurely?

- Truck Specifications and Condition: Thoroughly inspect the specific semi-truck you intend to lease.

- New vs. Used: New trucks offer warranties and the latest tech but come at a premium. Used trucks are more affordable but require more scrutiny of maintenance history, mileage, and potential wear and tear.

- Make, Model, Year, Engine, Transmission: Ensure the truck meets your operational needs (e.g., horsepower for heavy hauling, sleeper cab for OTR routes).

- Maintenance Records: Demand a complete history.

- Professional Inspection: Always get an independent mechanic to inspect the truck before signing.

- Provider Reputation: Research the leasing company or dealership. Look for reviews, check their financial stability, and verify their licensing. A reputable provider will be transparent and helpful.

- Insurance Requirements: Understand the comprehensive insurance coverage required by the lessor.

- Exit Strategy/Buyout Clause Clarity: Ensure the path to ownership is clearly defined and achievable. Avoid contracts with vague "fair market value" clauses that could lead to unexpected high buyout costs.

The Process: How to Lease a Semi Truck with an Eye on Purchase

Navigating the lease-to-own process involves several critical steps:

- Assess Your Needs and Budget:

- Truck Type: Day cab, sleeper, specific axle configurations? What kind of freight will you haul?

- Budget: Determine your realistic monthly payment capacity, including insurance, fuel, and maintenance.

- Creditworthiness: Understand your personal and business credit scores.

- Research Providers:

- Look into specialized semi-truck leasing companies, truck dealerships with in-house leasing programs, and commercial banks that offer equipment financing.

- Gather quotes from multiple sources to compare terms and rates.

- Pre-qualification and Application:

- Most lessors will require a credit application, business financial statements, and possibly a business plan. Be prepared to provide detailed financial information.

- Understand the approval criteria.

- Review Lease Offers:

- Carefully compare the various offers. Pay close attention to:

- The total cost over the lease term.

- The fixed buyout price or buyout formula.

- Included services (e.g., initial warranty, roadside assistance).

- All fees (origination fees, documentation fees, etc.).

- Carefully compare the various offers. Pay close attention to:

- Inspect the Truck:

- For used trucks, this is non-negotiable. Hire a qualified independent mechanic to perform a pre-purchase inspection.

- For new trucks, still do a thorough walk-around and test drive.

- Review all maintenance and service records meticulously.

- Negotiate Terms (If Possible):

- Depending on your credit and the truck’s demand, there might be room to negotiate the down payment, monthly payment, or even the buyout price.

- Don’t hesitate to ask questions and seek clarification on any confusing clauses.

- Sign the Agreement:

- Read the entire contract line by line. If necessary, have a legal professional review it.

- Ensure all verbal agreements are documented in writing.

- Maintenance & Operation:

- Adhere strictly to the lease agreement’s terms, especially regarding maintenance. Proper maintenance protects your investment and ensures the truck’s reliability.

- Exercising the Buyout Option:

- As the lease term nears its end, ensure you have the funds or financing ready for the buyout payment.

- Follow the lessor’s procedures to complete the transfer of title and officially become the owner.

Types of Semi Trucks Commonly Available for Lease-to-Own

The market for lease-to-own semi-trucks is diverse, catering to various operational needs and budgets:

- New Semi Trucks: These offer the latest technology, better fuel efficiency, full manufacturer warranties, and typically fewer initial maintenance headaches. Brands like Freightliner, Kenworth, Peterbilt, Volvo, International, and Mack are popular choices. Leasing a new truck to own allows you to benefit from its initial years of peak performance.

- Used Semi Trucks: A more budget-friendly option, used trucks (often 2-7 years old) are widely available for lease-to-own. They come at a lower price point and lower monthly payments. However, thorough inspection and a robust maintenance plan are crucial. Many owner-operators start with a reliable used truck to build their business before upgrading.

- Day Cabs: Ideal for local or regional hauling that doesn’t require overnight stays. They are generally less expensive to lease and operate.

- Sleeper Cabs: Essential for long-haul (Over-The-Road or OTR) operations, providing living quarters for drivers. These are typically more expensive but offer greater operational flexibility for long-distance freight.

- Specialized Configurations: While less common for initial LTO agreements, some lessors might offer specialized trucks like flatbeds, dump trucks, or heavy-haul tractors if there’s a specific demand and strong financial backing.

The choice between new and used, and the specific configuration, should align directly with your business model, projected routes, and financial capacity.

Challenges and Solutions in Lease-to-Own Agreements

While beneficial, lease-to-own agreements come with their own set of potential challenges:

- Higher Overall Cost (Potentially): Compared to an outright cash purchase, the total cost of a lease-to-own can sometimes be higher due to interest and fees.

- Solution: Conduct a detailed financial analysis. Compare total projected costs with traditional bank loans and cash purchases. Negotiate terms aggressively.

- Rigid Contracts: Lease agreements can be complex and less flexible than traditional loans, especially regarding early termination.

- Solution: Read every clause meticulously. Seek legal counsel if anything is unclear. Understand early termination penalties before signing.

- Maintenance Responsibility: In most LTOs, the lessee is responsible for all maintenance and repairs, which can be costly and unpredictable.

- Solution: Factor in a robust maintenance budget. For used trucks, demand comprehensive service records and get an independent inspection. Consider extended warranty options if available.

- Depreciation Risk (Upon Buyout): By the time you buy the truck out, its market value might have significantly depreciated, especially if you paid a premium through the lease.

- Solution: Choose a reliable truck model with good resale value. Maintain the truck meticulously to preserve its value. Ensure the buyout price is reasonable relative to the truck’s projected end-of-lease market value.

- Credit Requirements: While potentially more accessible than traditional loans, lessors still require a decent credit history (personal and business).

- Solution: Work on improving your credit score. Be transparent about your financial situation. Some lessors offer programs for newer businesses or those with less-than-perfect credit, often with higher down payments or interest rates.

Typical Lease-to-Own Cost Components and Considerations for Semi Trucks

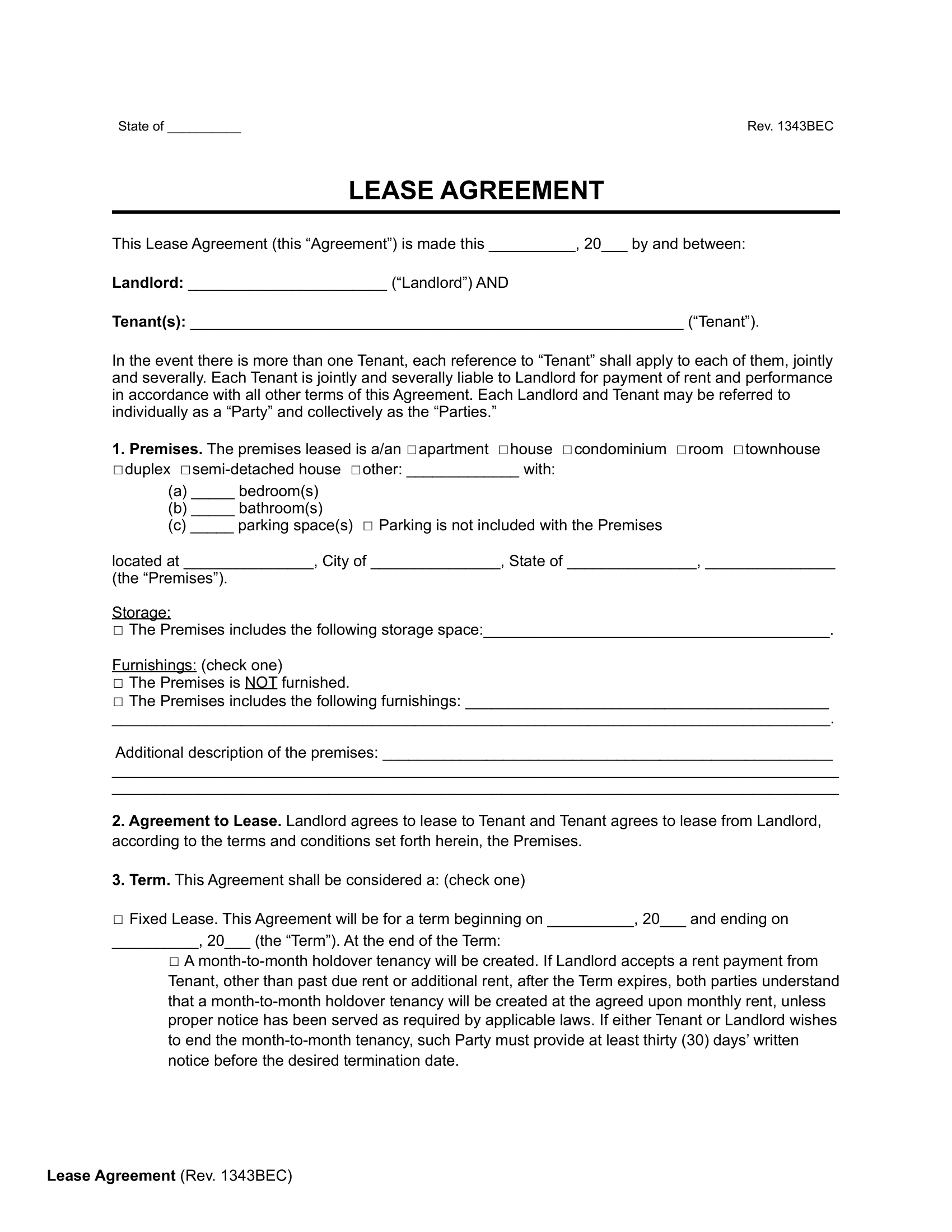

Understanding the financial landscape of a lease-to-own agreement is crucial. The table below outlines typical cost components and considerations, providing ranges rather than fixed prices, as these vary widely based on truck condition, make, model, age, and lessor.

| Aspect/Truck Type | Used Day Cab (3-7 yrs old) | Used Sleeper (3-7 yrs old) | New Sleeper Truck |

|---|---|---|---|

| Typical Truck Value | $40,000 – $80,000 | $60,000 – $120,000 | $150,000 – $220,000+ |

| Down Payment Range | $3,000 – $10,000+ | $5,000 – $15,000+ | $10,000 – $30,000+ |

| Estimated Monthly Payment Range (4-6 yr term) | $1,200 – $2,000 | $1,800 – $3,000 | $3,500 – $5,500+ |

| Typical Lease Term | 36 – 60 months | 48 – 72 months | 60 – 84 months |

| Buyout Option Type | Fixed Price/Balloon | Fixed Price/Balloon | Fixed Price/Balloon |

| Typical Buyout Amount | $1 – $5,000 (fixed) or 10-20% of original value (balloon) | $1 – $10,000 (fixed) or 10-25% of original value (balloon) | $1 – $15,000 (fixed) or 15-30% of original value (balloon) |

| Maintenance Responsibility | Lessee (Full) | Lessee (Full) | Lessee (Full, outside warranty) |

| Included Services | Varies (e.g., roadside assistance for 1st year) | Varies (e.g., initial inspection) | Manufacturer Warranty |

| Insurance Cost (Monthly Est.) | $500 – $1,000+ | $800 – $1,500+ | $1,000 – $2,000+ |

| Total Est. Cost (Over 5 yrs) | $75,000 – $130,000+ | $115,000 – $200,000+ | $220,000 – $350,000+ |

Note: These figures are estimates and can vary significantly based on credit score, market conditions, specific lessor, and truck features. Always obtain detailed quotes.

Frequently Asked Questions (FAQ) about Lease Semi Trucks For Sale

Q1: Is "Lease Semi Trucks For Sale" the same as renting a semi-truck?

A1: No. While both involve regular payments for truck usage, "Lease Semi Trucks For Sale" refers to lease-to-own or finance lease agreements where the explicit goal is to purchase the truck at the end of the term. Renting (or an operating lease) is purely for temporary use, with no path to ownership.

Q2: Can I lease a used semi truck with an option to buy?

A2: Absolutely. Leasing used semi trucks with a buyout option is very common and often more accessible for new owner-operators due to lower upfront costs and monthly payments compared to new trucks.

Q3: What kind of credit score do I need to qualify for a lease-to-own agreement?

A3: Credit requirements vary by lessor. Generally, a good personal and business credit score (e.g., 650+ FICO for personal, established business credit for companies) will give you the best terms. Some lessors specialize in helping individuals with less-than-perfect credit, but this often comes with higher interest rates or larger down payments.

Q4: Who is responsible for maintenance and repairs during a lease-to-own term?

A4: In almost all lease-to-own or finance lease agreements, the lessee (you) is responsible for all routine maintenance, unexpected repairs, and operational costs (fuel, tires, etc.), just as if you owned the truck outright. This is a key difference from some operating leases which may include maintenance.

Q5: What is a "balloon payment" in a lease-to-own agreement?

A5: A balloon payment is a large lump-sum payment due at the very end of the lease term. It represents the remaining principal amount required to purchase the truck outright. If your lease-to-own has a balloon payment, ensure you have a plan to cover it when due.

Q6: Can I negotiate the buyout price at the end of the lease?

A6: Typically, in a lease-to-own agreement, the buyout price is fixed and agreed upon at the beginning of the lease term. This provides certainty. However, if the buyout is structured as "fair market value," there may be room for negotiation based on the truck’s actual condition and market prices at that time.

Q7: What happens if I can’t make my lease payments?

A7: Missing payments can lead to severe consequences, including late fees, repossession of the truck, significant damage to your credit score, and potential legal action from the lessor. It’s crucial to communicate with your lessor immediately if you anticipate financial difficulties.

Conclusion: Your Strategic Path to Semi-Truck Ownership

The concept of "Lease Semi Trucks For Sale" offers a vital and often indispensable pathway for individuals and businesses aiming to establish or expand their presence in the demanding world of trucking. By understanding the nuances of lease-to-own and finance lease agreements, you can leverage lower upfront costs, predictable payments, and access to quality equipment, all while steadily building equity towards outright ownership.

However, this strategic path demands meticulous planning and thorough due diligence. From scrutinizing every clause in the lease agreement and understanding the true total cost of ownership, to diligently inspecting the truck and budgeting for ongoing maintenance, every step is critical.

For the determined owner-operator or the growing fleet manager, a well-chosen lease-to-own semi-truck isn’t just a vehicle; it’s a strategically acquired asset that empowers you to drive your business forward, turn miles into revenue, and ultimately, claim full ownership of your future on the open road. With careful consideration and a clear vision, leasing a semi-truck with an eye on purchase can be the most effective route to realizing your trucking ambitions.